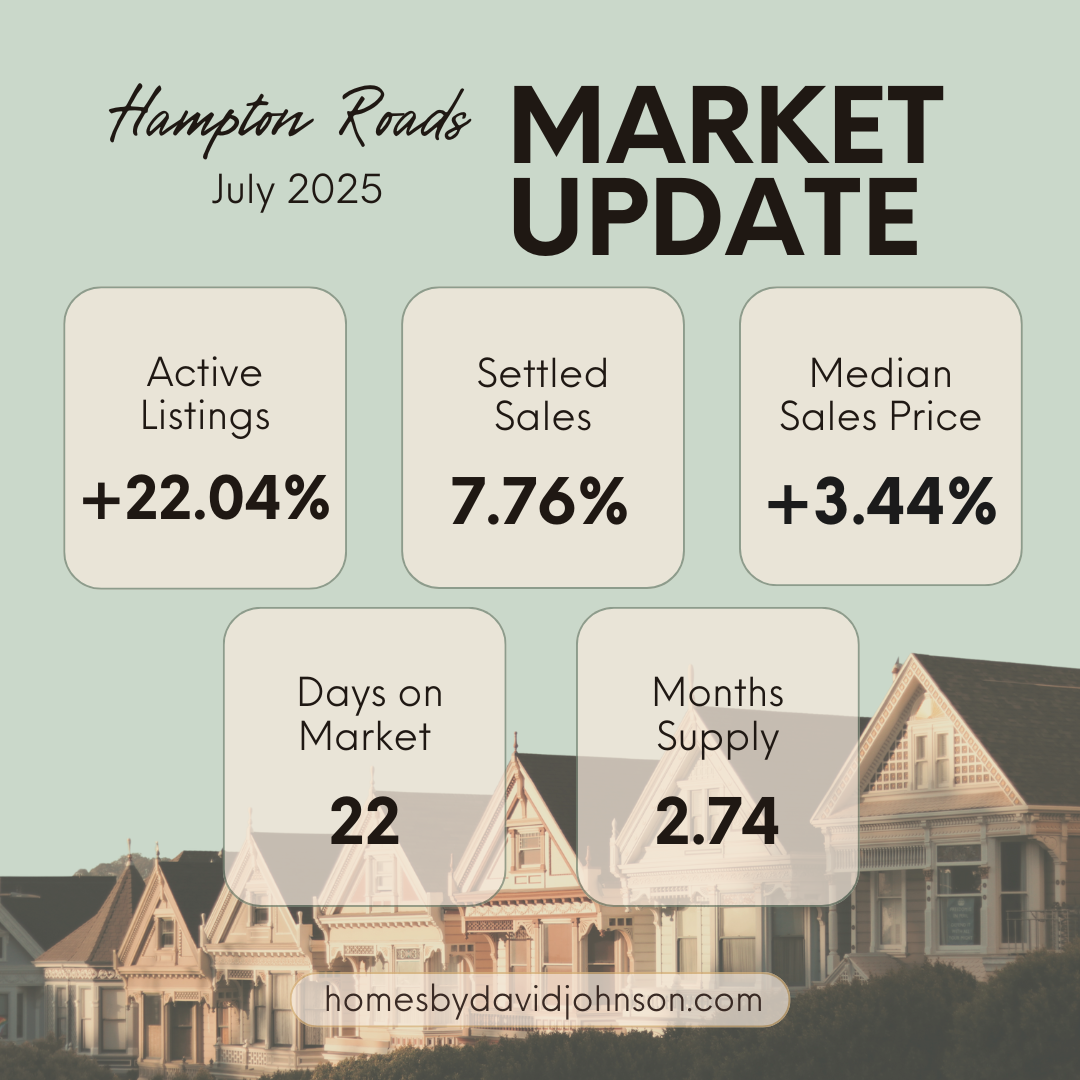

Hampton Roads Housing Market Update: July 2025

The Hampton Roads real estate market showed clear signs of renewed strength in July 2025, marking the second consecutive month of year-over-year gains in sales activity. According to data from the Real Estate Information Network (REIN), 2,528 homes were sold (settled) in July, a 7.76% increase from the 2,346 sales in July 2024. Likewise, pending sales, homes under contract that haven’t closed yet, hit 2,457 for the month, up 10.5% from the same month last year. This back-to-back improvement in June and July comes on the heels of a slight dip in May’s numbers, and it may signal that buyer confidence is returning to the market.

Several factors likely contributed to this rebound. Mortgage interest rates have stabilized in recent months, which has helped bring some hesitant buyers back into the hunt. After rising sharply in 2022–2023, rates have been fluctuating in a relatively narrow range this year. In fact, the average 30-year fixed mortgage rate in late July was around 6.7%, about the same as a year ago. This rate stability (even with rates higher than a few years ago) at least provides certainty for buyers planning their budgets, and recent slight dips in rates have even modestly boosted buyers’ purchasing power. The combination of steady rates and increased inventory has been keeping buyers engaged in the market. Buyers who were on the sidelines are now seeing that conditions are not worsening; if anything, they’re improving, and that’s motivating action.

Inventory Hits a 5-Year High, Easing Pressure

Perhaps the most striking development in the July report is the surge in housing inventory. Active residential listings climbed to 5,664 homes, the highest number of homes for sale in Hampton Roads since June 2020, over five years ago. This is a substantial 22% jump compared to the 4,641 active listings we had in July 2024. Such an influx of inventory is a welcome change for a market that, in recent years, was defined by ultra-low supply. To put it in perspective, at one point in 2020–2021 the region had fewer than 4,000 homes on the market, creating fierce competition among buyers. Now, with inventory swelling, the dynamic is shifting towards a more balanced playing field.

All seven major cities in the Hampton Roads area saw year-over-year increases in active listings in July. This broad-based rise suggests that homeowners are more willing to list their properties, perhaps encouraged by the strong prices homes have fetched recently. It could also indicate that some who postponed selling during the uncertainty of the past couple of years are now coming to market. Whatever the reason, more “For Sale” signs are popping up across the region, and that’s good news for buyers.

With more choice available, buyers aren’t feeling as pressured to snap up the first property they see. We can already see evidence of this in the median days on market (DOM): for July, the median DOM was 22 days, up from 18 days in June and also 18 days a year ago. Homes are still selling relatively quickly (just over three weeks on average is not very long historically), but this is a slight slowdown from the frenzied pace we had when inventory was sparse. In essence, houses are taking a few days longer to sell, likely because buyers have more options to consider and can afford to be a bit more deliberate in their house hunting.

Another way to look at inventory and market balance is the Month’s Supply of Inventory (MSI). In July, MSI for Hampton Roads was 2.74 months, up from 2.65 in June, and significantly higher than the 2.28 months of supply we had in July 2024. MSI represents how many months it would take to sell all current listings at the current sales pace if no new listings came on the market. Generally, an MSI of around 5 to 6 months is considered a balanced market; anything less means a seller’s market, anything more a buyer’s market. At 2.7 months, we are still in a seller’s market territory, but notably less extreme than the sub-2-month supply we saw during the pandemic boom. The upward tick in MSI indicates negotiating power is gradually shifting: while sellers still have an advantage, buyers are gaining ground with each additional month of supply added.

Prices: Slight Dip from Peak, Still Up Year-on-Year

Home prices in Hampton Roads remain strong, though July brought a modest tempering from the record high we saw in June. The median sales price (MSP) for the region in July 2025 was $368,250. This is about 1.8% lower than June’s median (which hit $375,000, the all-time high for our area), but importantly, it’s 3.44% higher than the median price recorded in July 2024. In other words, home values are still rising year-over-year, but the pace of increase has eased slightly, and we even saw a small month-to-month price correction after June’s peak.

For buyers, this small price dip from June is welcome news. It suggests that the rapid price appreciation of the last couple of years is leveling off. More inventory means less upward pressure on prices, and we may be entering a phase of price stabilization. In fact, local experts have been predicting that an increase in supply would help keep prices in check. That prediction seems to be coming true; July’s numbers show prices flattening a bit instead of continuing on a steep climb. To be clear, prices are not dropping in a dramatic way (again, we’re up 3–4% from last year), but the market isn’t as overheated as it was, say, in 2021 when double-digit annual price gains were the norm.

From a seller’s perspective, you might not break the record price that was set a month ago, but you are likely still selling for more than you would have last year. The slight cooldown in median price month-to-month could actually be beneficial in sustaining the market’s health. If prices grew too fast, many buyers would be priced out, reducing demand. Instead, what we have now is continued buyer interest (evidenced by higher sales and pendings) alongside prices that are rising moderately. This dynamic hints at a market reaching a sustainable equilibrium.

It’s also worth noting that Hampton Roads remains affordable relative to many other regions. Even at $368k, our area’s median price is below the national median (which was around $410k – $430k as of mid-2024) and below Virginia’s statewide median (which was in the low $400s). This relative affordability could be another factor that’s drawing in buyers, including some from higher-cost markets, now that more homes are available.

Local City Spotlight and New Construction Trends

Drilling down a bit, different cities within Hampton Roads have experienced the market changes to varying degrees. One standout is Chesapeake, which logged the highest median selling price among the region’s cities in July, at about $420,000. This likely reflects the mix of housing in Chesapeake (which includes many newer developments and larger homes) and continued high demand there. Cities like Virginia Beach and Suffolk also saw robust sales and price growth, bolstered by their desirability and limited new land for development. On the other hand, some cities such as Norfolk, Hampton, and Newport News had a slight year-over-year decrease in settled sales (around a 1–4% dip in those locales). These minor declines in a few cities don’t change the overall positive regional picture, but they remind us that real estate is hyper-local; factors like military relocation patterns, new employers, or even the timing of new home construction can affect one city’s numbers differently than another’s.

Speaking of construction, new construction homes continue to play an important role in our market. In July, about 210 newly built homes were sold via the MLS, up from 201 a year ago. However, that 210 figure is down from the 260 new homes sold in June. It appears that while builders have been ramping up activity compared to last year (to help fill the inventory gap), there was a bit of a slowdown in closings of new homes compared to the prior month. This could simply be timing; June saw a surge of new home closings, and July eased off, or it might reflect labor and supply challenges that builders are still navigating. Overall, the year-to-date trend shows more new homes entering the market than in 2024, which contributes to the higher inventory we’re now seeing. For buyers, new construction offerings can be attractive, but keep in mind they often come at a premium price. The fact that they are selling slightly slower than in June may give buyers a bit of negotiating leverage on new builds as well.

What It Means for Buyers and Sellers

In summary, the Hampton Roads housing market in July 2025 is characterized by rising activity and a growing inventory, which together are fostering a healthier balance between buyers and sellers. If you’re a buyer, conditions have improved markedly from a year or two ago: you have more homes to choose from and a bit more time (and less competition) to make decisions. Mortgage rates, while higher than the historic lows of 3% we saw in 2021, have been stable in the mid-6% range for a while and even dipped to their lowest levels since spring. That stability can help you plan your purchase with confidence. Plus, with price growth moderating and fewer bidding wars than in the frenzy of 2021, buying a home is becoming a bit less daunting. You might even get a chance to include home inspection or appraisal contingencies again, which had often been waived in the ultra-hot market before, a sign that negotiating power is evening out.

If you’re a seller, don’t be discouraged by the rising inventory; homes that are priced well and in good condition are still selling briskly. Remember, sales are up and buyers are very much out there. The key difference is you may not get dozens of offers on day one anymore, and you might need to be more patient. Work with your real estate agent on a smart pricing strategy: the goal is to be competitive and attract those motivated buyers who now have more options. The good news is, you’re likely still getting a higher price than you would have last year, and likely near record-high values, given the year-over-year appreciation. It’s also a great time to move up or downsize locally, since the trade-up market is healthier, you can sell your current home and actually have a selection of new homes to choose from for your next move.

Looking Ahead

If these trends continue, Hampton Roads could be entering a period of sustainable growth rather than boom-and-bust. Real estate experts in Virginia describe the current environment as a “recalibration” toward normalcy, an apt description for what we’re seeing in our region. Inventory is expected to keep improving (July historically is a peak listing month, and many sellers also list in the early fall as the next window), and as long as interest rates don’t spike dramatically, buyer demand should stay resilient. We will be watching to see if the fall market maintains this momentum of year-over-year gains. Two months of improvements is a great sign; a third or fourth would really cement that we’ve moved past the soft patch and into a more confident market phase.

In conclusion, July’s housing metrics paint an optimistic picture for Hampton Roads. The market is more balanced than it’s been in years, creating advantages for both sides of the table. Buyers enjoy more choices and slightly better affordability, while sellers benefit from an increase in ready and willing buyers compared to last year. It’s a healthier market overall. Whether you’re considering buying your first home, moving up to a bigger one, or selling a property in Hampton Roads, now is a great time to reevaluate your plans. With the latest data in hand, you can approach your real estate decisions with confidence and clarity about where the market is headed. As always, staying informed is key, and we’ll continue to provide updates as new data comes in. Happy home shopping (or selling)!